Love is a beautiful journey, and everybody wants to be on board the love boat. This Valentine’s Day is no exception: many decide to give new love a chance, while others celebrate their ongoing adventure (which on the other 364 days of the year is not as romantic as on February 14th). The reasons the ride gets bumpy are several, and often the same, according to a 2019 study by the University of Tennessee: children, in-laws, intimacy, and, our favorite, money.

The origin of many financial conflicts can be explained by how one’s family handled finances. Dr. Alex Melkumian, founder of the Financial Psychology Center in Los Angeles, CA, told CNBC Select how everyone’s “money story” starts at childhood. “The foundation of anyone’s understanding and relationship with money is based with their family of origin coupled with any financial literacy education they receive throughout their life,” he said, and added, “It’s rare that in a romantic relationship both partners come to it with the same, or similar, money story.”

Therefore, for a successful “money story” in a relationship, the best is to approach the financial conversation early on. “The first thing to be aware of in a relationship would be having good communication and making sure you all know where you are financially” warns Poppy Fox, Investment Director at Quilter Cheviot Ltd. But if you are just getting to know someone, how do you start the conversation?

The Foundation of Communication

The first step in building a robust financial foundation with your partner is clear communication. Imagine moving in together—expenses become shared, and conversations about money become inevitable. But where do you start? How do you approach that conversation even before moving in with someone? It's all about understanding each other's financial standing, both individually and as a couple. Poppy recommends having those conversations when things are nice rather than waiting until «it gets a little bit awkward».

«When you're having a conversation with someone on Valentine's Day, you're typically talking about romance, everything's wonderful. You hope it will stay that way, but there will be tough times. So it's about knowing that plans are in place for everybody to be protected, should those times come».

So what plans are we referring to? “When we talk about finances, we're talking about long-term plans, looking forward to retirement, looking forward to that nest egg, looking forward to passing on that wealth» clarifies Poppy. Even though things like the household budget are essential, where people are financially not only as a couple but as individuals, can be quite different. “Exploring what that means is empowering, it gives you control, comfort, and also a choice”, adds Fox.

Still, particularly in the early stages of a relationship, getting the courage to ask what their financial plans are and how do they make them together is for many a sensitive topic. Poppy has the perfect excuse for that: “Solicitors often tell the client they can blame it on them if they're struggling to have the conversation. So, if you feel insecure, just blame it on us, the professionals, whether is the lawyer or the financial adviser”.

Protecting Your Partnership

Once you've laid the groundwork with communication, the next consideration is protection. Whether it's buying a property together or discussing long-term plans, seeking professional advice is like creating a financial safety net. Nowadays many recommend living together agreements, to protect both parties. They can be initiated by parents or grandparents who want to protect the financial contributions they make towards a property or their beneficiary.

If the next step in the relationship is getting married, a prenuptial agreement is the logical step. «I think prenups have a bad reputation because we've seen them as this big American thing, like in the movies, where somebody's got billions of dollars and they're marrying somebody who probably would not have been with them had it not been for the money. So that's where the perception of it comes in. A lot of people say, ‘I don't need a prenup because I haven't got millions of pounds’, but it's not about that. It's just about saying should we hit a hiccup, everybody knows where everything is. So it's very amicable, all agreed and that's it, nice and simple”.

Discussing prenuptial agreements may be challenging, but it's crucial to approach it with sensitivity. Second marriages often find it easier to bring up this topic, having learned from past experiences. But again, is not about mistrust; it's about ensuring clarity and protection for both parties involved. Poppy remarks: «I think that's a really key point where couples or individuals should always be seeking professional advice».

The Female Financial Journey

Statistics show that women often take charge of the household budget but may not be as involved in long-term financial planning. It's essential to distinguish between day-to-day expenses and the broader, forward-thinking financial plan. By having conversations about both daily budgets and long-term goals, couples can align their visions for the future.

«Understanding the household budget is one thing but understanding the long-term financial goals is a different matter altogether». And if you are thinking of starting a new chapter together, you might not go into it equally.

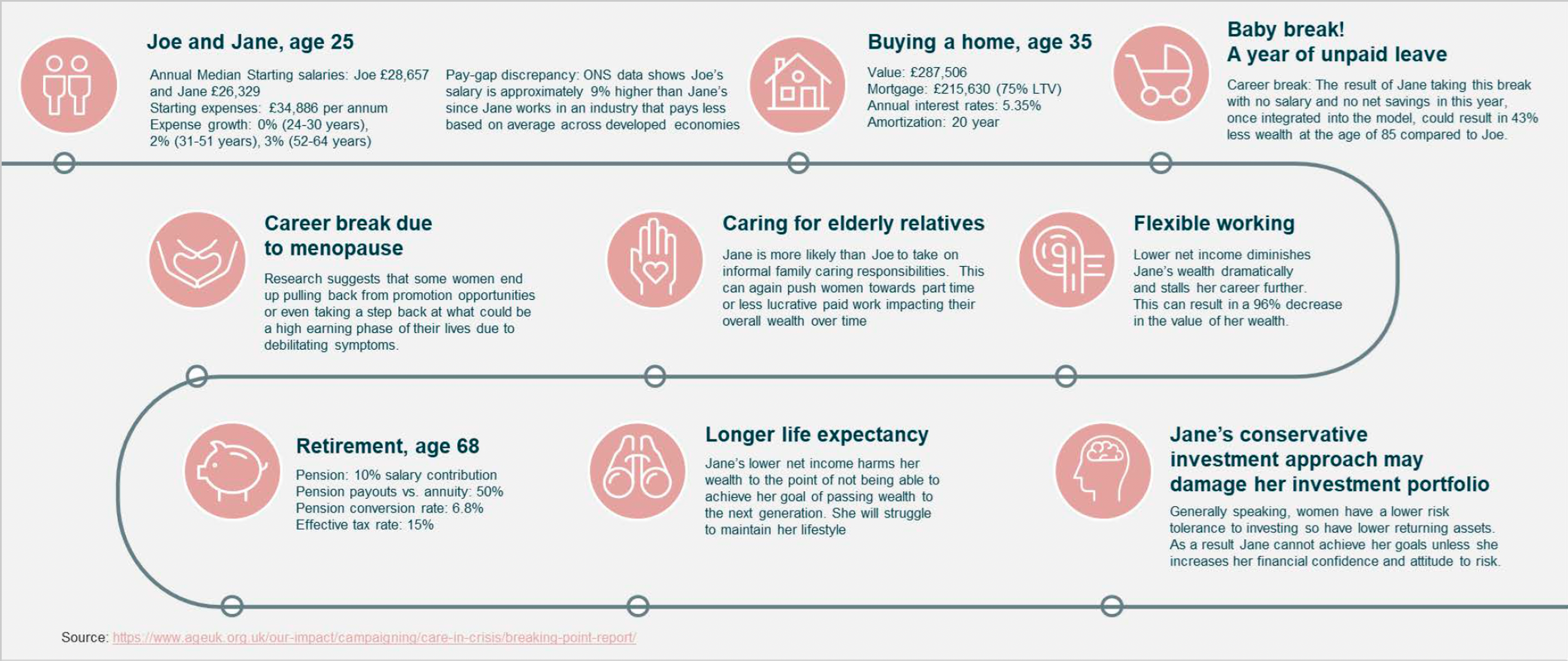

Women’s financial journey is quite different than the one men go through, since women must overcome a lot of financial hurdles: “The baby break is a big one, and whilst these days mum and dad can have maternity and paternity leave, typically it still falls on the woman to have that break from work», Poppy reminds us. At the same time, COVID drove up the gender pay gap again, because the responsibility for childcare during the pandemic fell more on the female than on the male. All these things turn into financial disadvantages in the long-term. “Who needs to care for the children comes into play, which is where that flexible working falls on the women, as well as caring for elderly relatives. These could have all sorts of consequences. Career break due to menopause is also big thing. Women might decide that they can't be in the workplace anymore or they want to go part-time. All of those decisions have a financial implication, just the same as the baby break».

Finally, women have a longer life expectancy, therefore having funds to support later life is key. «And that gender pay gap also falls into the gender pensions gap. Because even if you're contributing the same amount of your salary, if you're taking sort of breaks or you're working part time or you're not taking those promotions because it doesn't fit into your lifestyle, that also has an impact on what you end up with in retirement”.

Buying a Home Together

Owning property is often seen as a significant milestone. However, the process is more complex than simply splitting costs. «Buying a house as an individual these days it’s more difficult because you've only got one salary to base your mortgage on, whereas if there are two of you then the property can even be more comfortable.

Poppy explains that many are passing property down the generations, which can make the situation unequal: «If you were renting with somebody and decide to move into this newly inherited home, having that living together agreement is key, because it specifies who owns what. The same arrangement can help when one person wants to use their savings for the deposit, but then both pay the mortgage. Even if one person is doing everything financially as far as the house is concerned, but the other one decides that they're going to decorate the living room, for example, they then have contributed to the property. And even though it's decorative, they’ve put some shelves up, which means that financially they could potentially have a legal claim to the property.» Once more, getting financial and legal advice from professionals can protect you as an individual and make things easier as a couple.

Family Planning and Financial Awareness

So now you are married, you have the house, and those big rooms become the perfect place to grow a family. When couples decide to have a baby, financial awareness becomes predominant. Splitting tasks and responsibilities can make everyday seem fair, but it's essential to view the household as a unified financial entity. While one partner may contribute more financially, the other's role in childcare and household management is equally valuable. Poppy insists in bringing women into the conversation, since traditionally men have led the financial discussions: «To achieve financial success as a couple, it's crucial to involve both partners in financial decisions. Traditionally, only one spouse may attend meetings, but we believe in valuing the contributions of both individuals equally. Even if one person doesn't contribute financially, their role is still valuable. Each partner brings unique assets, and together, they can achieve great things.”

Professional advice can facilitate conversations and align investment strategies to complement each partner's risk tolerance and financial personality. “It is our role to make sure we're speaking to both parties, that's something I think we as an industry are becoming much more aware of.”

Red Flags and Financial Awareness

Lack of financial awareness within a relationship is a significant red flag. Couples should discuss their individual and joint financial positions, set clear goals, and regularly check in with professionals to stay on track. If one partner feels they've contributed more, it's crucial to approach the situation with empathy and acknowledge the diverse roles each person plays.

«Lack of awareness about each other's finances can be a major red flag in a relationship. It's important to have a clear understanding of joint responsibilities and goals, even if you have different approaches to money. Having a plan doesn't mean everyone has to do the same thing; it's about finding complementary ways to manage finances. Without awareness, there is cause for concern», assures Fox.

Building a strong financial foundation in a relationship requires open communication, legal protection, and professional guidance. It's about recognising the unique financial journeys of both partners and understanding that each contribution, whether monetary or through responsibilities, is invaluable. So, this Valentine's Day, express your love not just through words but through a commitment to a shared financial future. Seek professional advice, ask questions, and embark on the journey of love and finances together. After all, a strong financial foundation is the key to a lasting and successful partnership.